Tax Planner

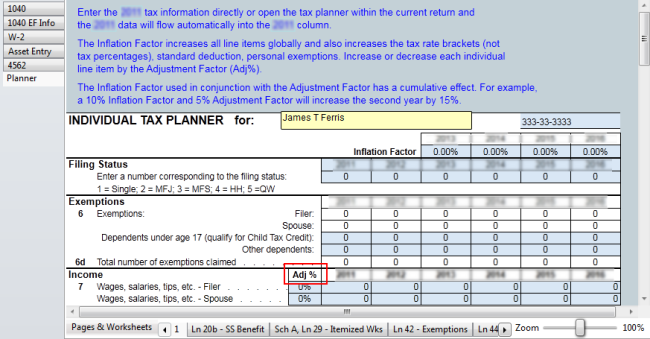

The Tax Planner worksheet, which is part of the Planning and Analysis function, is a three-page worksheet that can be added to a return via the Forms menu. The Tax Planner helps you calculate an inflation-adjusted, six-year projection of your client's tax data. You can adjust amounts to grow or decrease at rates you specify.

To use the Tax Planner worksheet:

- Open the return.

- Click the Forms menu, expand the Planning/Analysis fly-out menu, and then select Tax Planner.

Tax Planner

Tax Planner instructions appear at the top of Page 1.

- Be sure to review all pages of the worksheet.

You can also add the Tax Planner worksheet to a return via the Add Forms function. In the Find field of the Select Forms Dialog Box, enter Tax Planner. Select the Planner for the return type (such as 1120 Planner), and click Open Forms. The worksheet is added to the return.

To show a downward trend in earnings or expenses, enter negative numbers in the Adj % column (outlined).

See Also: